| Intro |

For many entrepreneurs, inventory feels like a mystery products move, money moves, and yet the profit stays elusive. But the problem isn’t sales it’s usually poor inventory tracking. And behind every missing profit is a missed calculation.

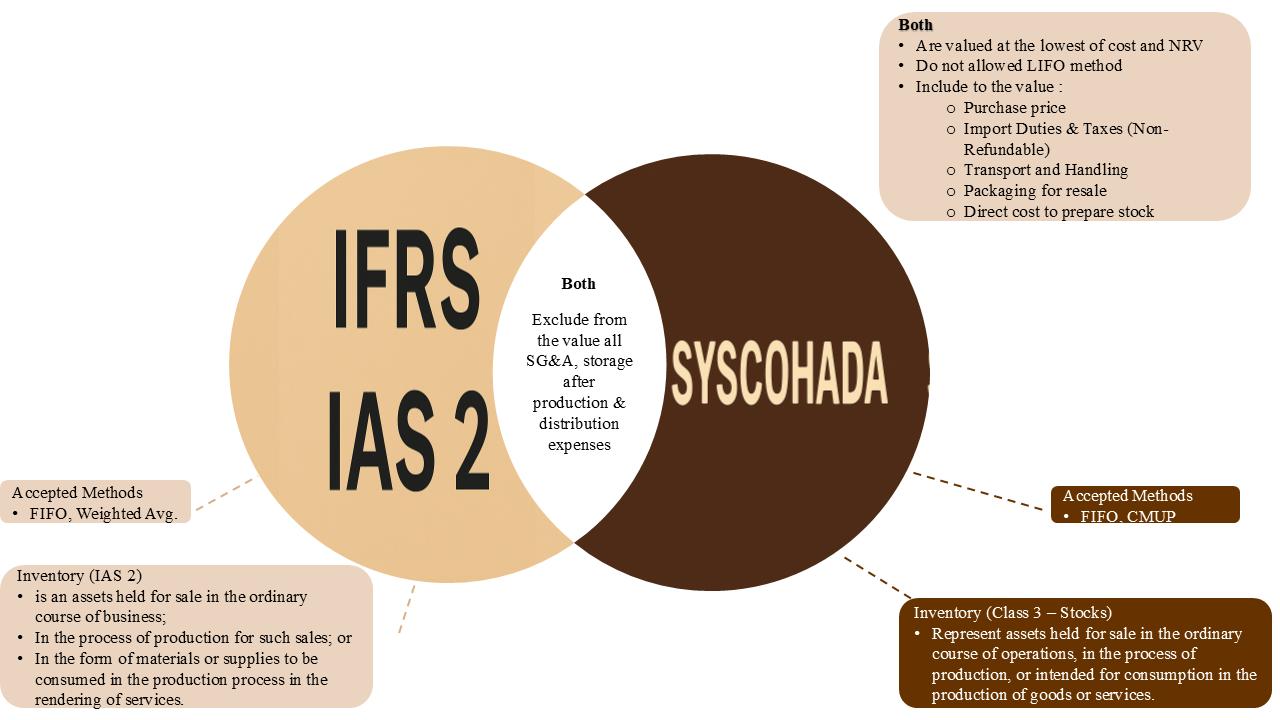

This article will provide guidance for applying IFRS and SYSCOHADA accounting policy with respect to inventories. The policy addresses the recognition, measurement, derecognition, presentation and disclosure requirements in relation to inventories.

| What is an Inventory? |

| Recognition |

Under both IFRS and SYSCOHADA standards, inventory should be initially recognized when the entity obtains full control over it, expects it to generate future economic benefits, and can reliably measure its cost.

| Why It Matters |

- Incorrect inventory = incorrect profit, taxes, and decisions

- It affects your COGS, margins, and working capital

- If you underprice or overstate stock, you may be making fake profits or losing real ones

| Meet Shaï and her professional advisor (Fatou) |

Shaï is two years into her cosmetics brand. Her customers love her shea butter moisturizers, clay masks, and hibiscus oils. Orders were climbing, but her profit wasn’t matching her hustle. She restocked, restocked again… and still felt broke.

So, she called her old friend and accountant, Fatou, for a business reality check.

Fatou: “Let me grab my laptop so we can review what should be in your inventory value first. It’s not just what you paid the supplier.”

Inventory Value (IAS 2 / SYSCOHADA) includes:

- Purchase price

- Non-refundable taxes and customs

- Transport to your location

- Packaging for resale

- Handling costs to get the item ready for sale

Shaï: “What about the products I lost last week? The shea butter that melted in the sun?”

Fatou: “Damaged or expired stock must be written off. That’s a loss. You record it as an expense, don’t let fantasy inventory boost your profits.”

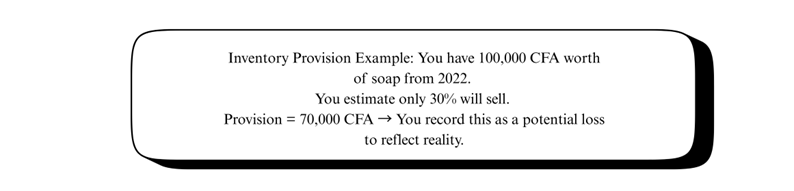

Shaï: “Okay, but what about that old hibiscus soap I’ve had since last year?”

Fatou: “That’s slow-moving inventory. You create a provision for that. You estimate how much of it may not sell and reduce your stock value accordingly.”

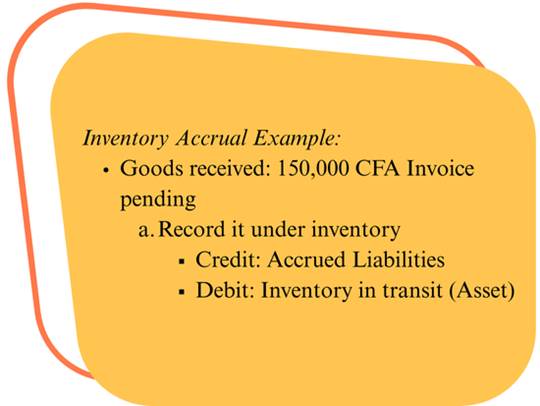

Shaï: “One more thing. I received boxes from my supplier last week, but no invoice yet. Do I include that?”

Fatou: “Yes! If the goods are received and usable, they go into your inventory. Create an inventory accrual, you owe the money even if the bill isn’t in yet.”

| Moment of Clarity |

After staying late:

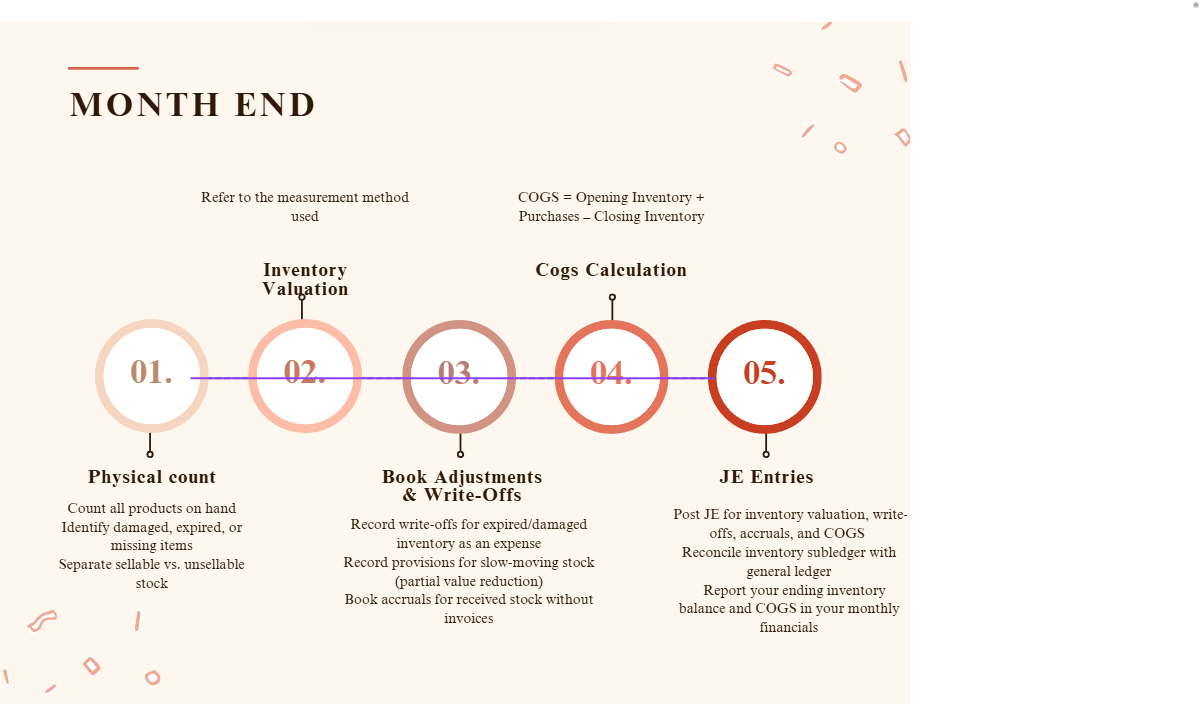

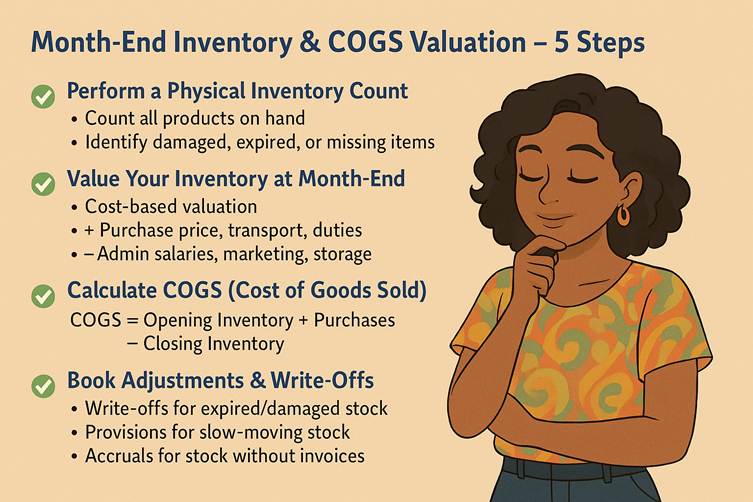

- Shaï did her first physical inventory count

- Created a simple Excel template for tracking

- Labeled expired goods

- Made a note to provision for slow-moving items

- Created a “pending invoice” folder for inventory accruals

She whispered to herself, “Now I run a business, not a boutique of confusion.”

| Shaï Takeaways |

| Closing Insight |

At the heart of every thriving business is not just what is sold, but what is seen, tracked, and understood.

Inventory is not a static asset, it’s a living indicator of control, discipline, and strategic foresight. It connects operations with finance, and intention to execution.

When business owners neglect the value of proper inventory management, they don’t just risk accounting errors, they risk misreading the health of their entire enterprise.

But when they embrace it, and apply sound accounting standards, they begin to see beyond the numbers. They gain clarity, make sharper decisions, and protect their margins.

Financial intelligence begins with what you see, and inventory is where visibility starts.

Annexes