Tax compliance can be intimidating, but it’s a cornerstone of business sustainability. For SMEs in Mali and beyond, understanding tax obligations is key to staying on the right side of the law.

Common Tax Types

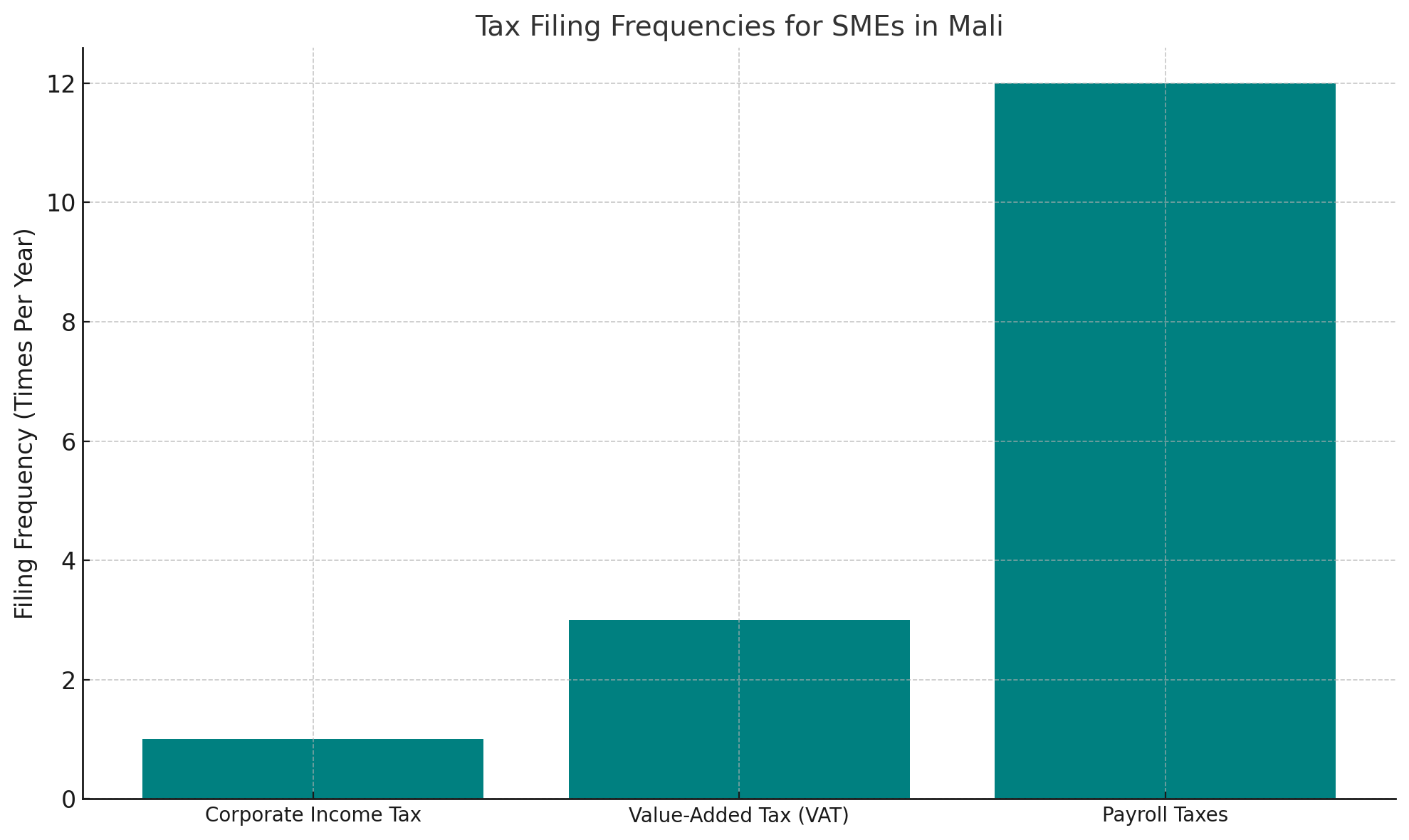

- Corporate Income Tax: Paid annually on business profits.

- VAT: Charged on goods and services.

- Payroll Taxes: Covers social security contributions for employees.

Filing Deadlines

- Corporate Tax: Due within 4 months of the fiscal year-end.

- VAT: Filed monthly or quarterly.

- Payroll Taxes: Submitted monthly with payroll processing.

Steps to Ensure Compliance

- Register Your Business

- Obtain a tax ID.

- Open a corporate bank account.

- Maintain Accurate Records

- Track all transactions with SYSCOHADA standards.

- Use software to avoid errors.

- Leverage Deductions

- Claim allowable expenses like equipment purchases.

- Work with a tax advisor for optimization.

Penalties for Non-Compliance

- Fines for late filings.

- Interest on unpaid taxes.

- Legal consequences for fraud.

Conclusion

Tax compliance doesn’t have to be a headache. With proper planning and tools, you can meet your obligations seamlessly and focus on growth.